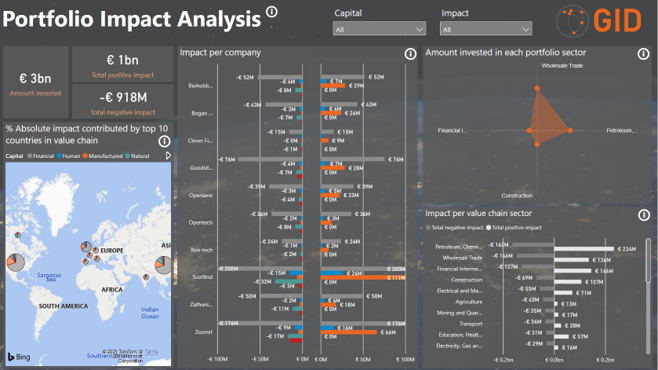

Your societal impact data solution

Our Global Impact Database provides verified and robust impact data, estimating impacts for organisations, countries and sectors worldwide. Impact data supports business and financial institutions towards understanding, reporting, and managing the societal impacts of their value chains, own operations, and investment portfolios, making it easy to identify risks and opportunities beyond financials and start your data-driven impact journey.